POLICY BRIEF: The Cost of Public Pension Funds to Taxpayers

KEY POLICY INSIGHT: This analysis focuses on how public pension policy choices impact taxpayers. It begins by finding a wage increase that makes public employees indifferent between defined benefit and defined contribution plans. There are potential gains for taxpayers when a defined contribution plan is used instead of a defined benefit plan. Those gains arise because taxpayers are funding lower levels of insurance against adverse asset market events.

THE ROLE OF THE TAXPAYER

U.S. public pension funds are underfunded. Recent estimates suggest that public pension funds have 71 cents in assets for every dollar of future pension benefits.₁ These funding deficits raise two important policy issues. First, how should current pension deficits be funded? Second, can taxpayer and beneficiary interests be improved by changing pension policy?₂ These issues are important because public sector and private sector employees are given different pension choices.₃

The critical issue of the impact policy choices have on public employees is addressed in an earlier policy brief. This brief discusses how taxpayers could be made better off by switching public employees from a fully defined benefit (DB) system to a partial defined contribution (DC) system.

This analysis recognizes that private sector employees are providing public employees wages, regular pension contributions, and a form of insurance. To isolate the impact of pension policy on taxpayers, we assume that public employees receive a wage increase so that they are indifferent between defined benefit and defined contribution systems. Finally, it is assumed that governments commit to a policy of 80% funding of the public employee defined benefit system - i.e. paying into the fund according to their schedule of Actuarial Required Contributions. (This assumption is counterfactual).

In this stylized example, taxpayers gain when public employees are switched to a partial DC plan when:

1. Defined benefits are high (relative to final pay), and

2. Wage differentials between public and private employees are low.

This brief, which focuses on the implications for taxpayers, combined with the Understanding Retirement Income Risk brief, which focuses on pension beneficiaries, offers a complete framework for evaluating alternative pension policies. A key feature of this analysis is highlighting the importance of policymaker commitment to a funding policy beneficial for taxpayers.

DEFINED BENEFIT PLANS AS INSURANCE

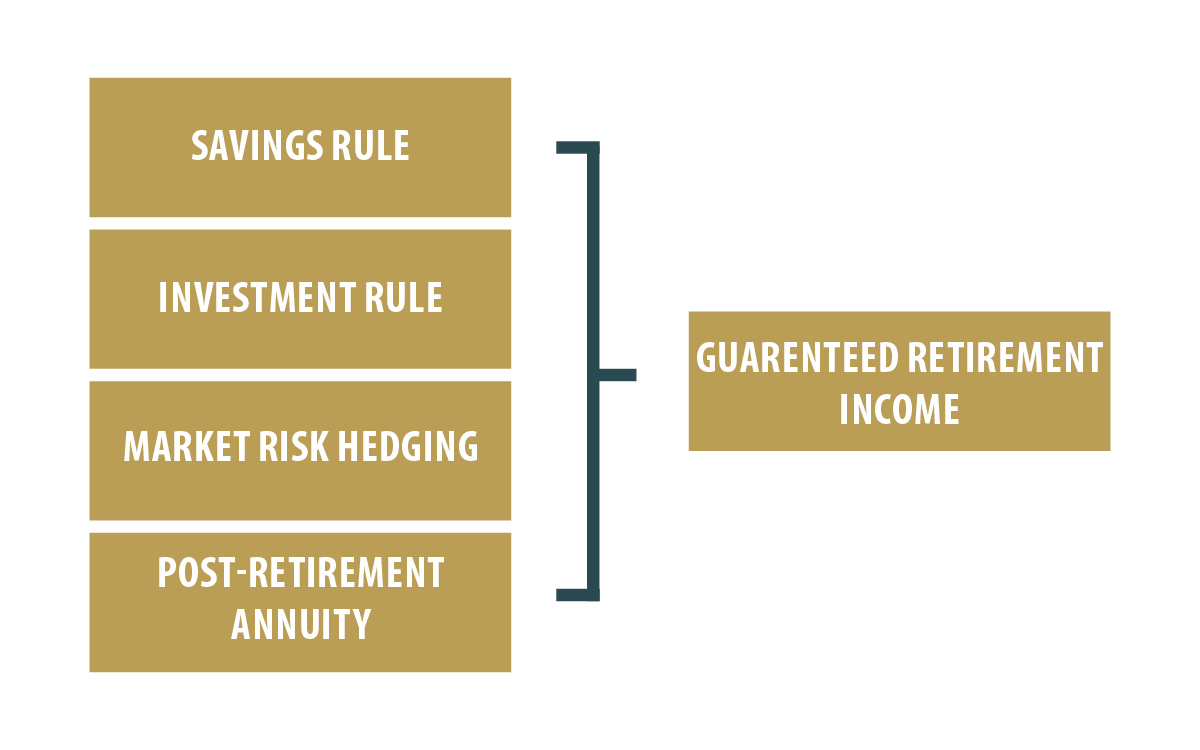

Regardless of whether a pension system is defined benefit, defined contribution, or some hybrid, its structure has four main components. These are:

1. Savings during working years

2. Investments during working years

3. Insurance against adverse market moves during working years, and

4. An annuity for retirement years.

Exhibit 1 provides a structure for evaluating policy tradeoffs. Because each component of this structure can be priced, policymakers can analyze the impact of alternative policies on the main constituencies - taxpayers and beneficiaries.₄ For example, defined benefit plans seem attractive to pension beneficiaries because they guarantee some level of retirement income. However, there may be alternative policies that leave beneficiaries no worse off but improve welfare for taxpayers.

TAXPAYER’S SAVINGS AND INVESTMENT PROBLEM

The impact of public pension policy on taxpayers is analyzed using the same lifecycle portfolio choice model as was used in the brief focused on pension beneficiaries.

This model is especially relevant for taxpayers - no more than 15% of private sector workers have access to a defined benefit system.₅ The two main differences from the set-up described in the earlier brief are:

1. Private workers fund public sector pensions through taxes, and

2. The government’s funding policy determines the level and volatility of taxes.

These differences help explain the impact of policy choices on taxpayers.

The simplest way to think about tax and funding policy is as follows. Taxpayers pay a tax to the government. Tax revenue is then used to pay a wage and a pension contribution to public employees.₆ If public employees participate in only a defined contribution plan, then the pension contribution (and by extension tax rates) from taxpayers depends only on the growth and volatility of public employee wages.

In public employee defined benefit plans, retirement income is guaranteed. Consequently, the funding rule can make a difference for tax rates. For a simple (and counterfactual) example, suppose the funding rule is that the pension plan is always fully funded (i.e. no deficits or surpluses). In this case, whenever the pension is underfunded, taxpayers will pay a higher tax. By contrast, whenever the pension is overfunded, taxpayers will receive a tax rebate.₇ Now, the pension contribution from taxpayers depends on the growth and volatility of wages and the volatility of the investment portfolio (because the funding of the pension system depends on investment risk).

This simple example shows that in defined benefit systems with fixed retirement payments, taxpayers are insuring beneficiaries against adverse effects in financial markets. Consequently, the choice of funding policy and commitment to that policy could matter for taxpayers.₈

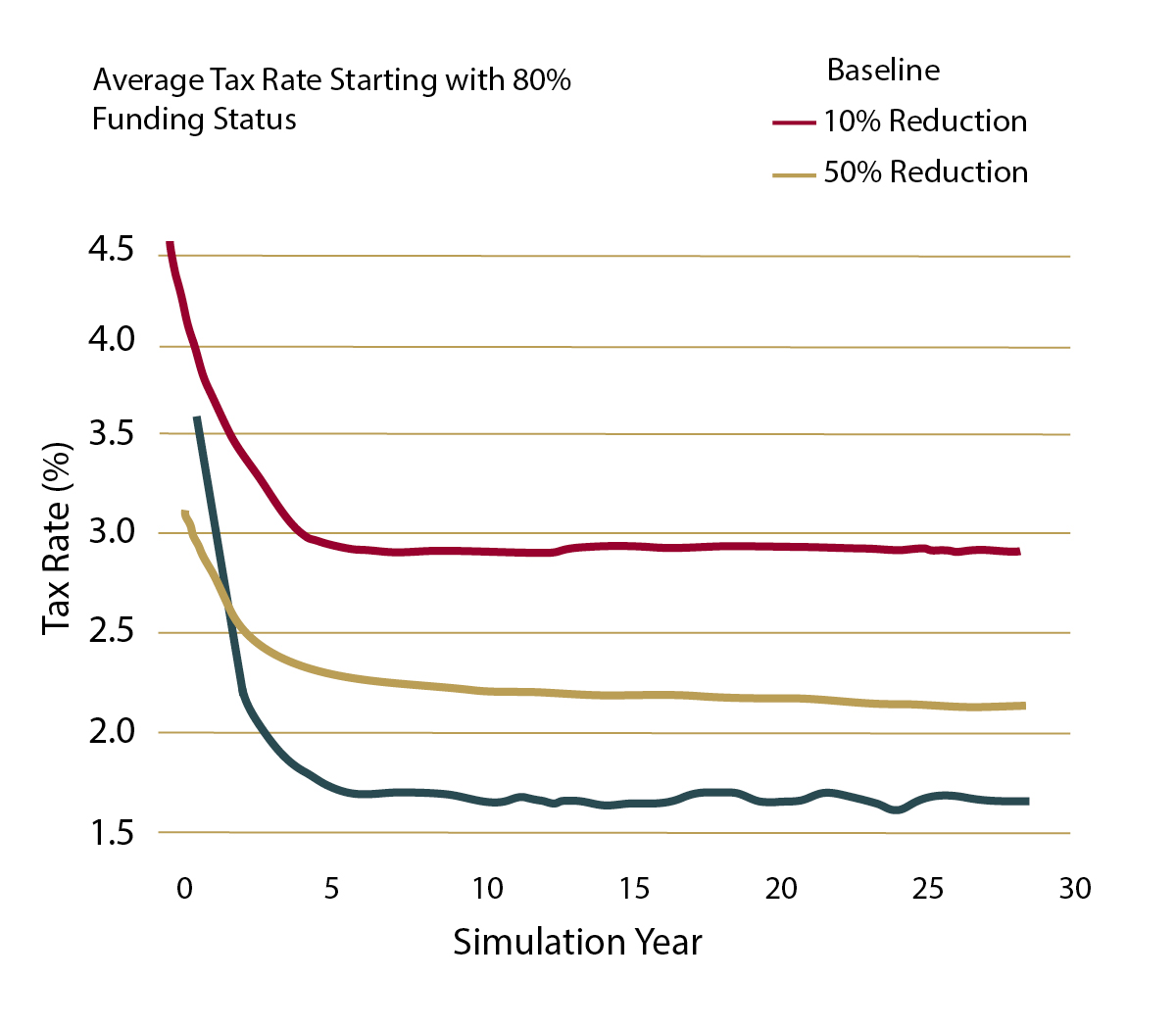

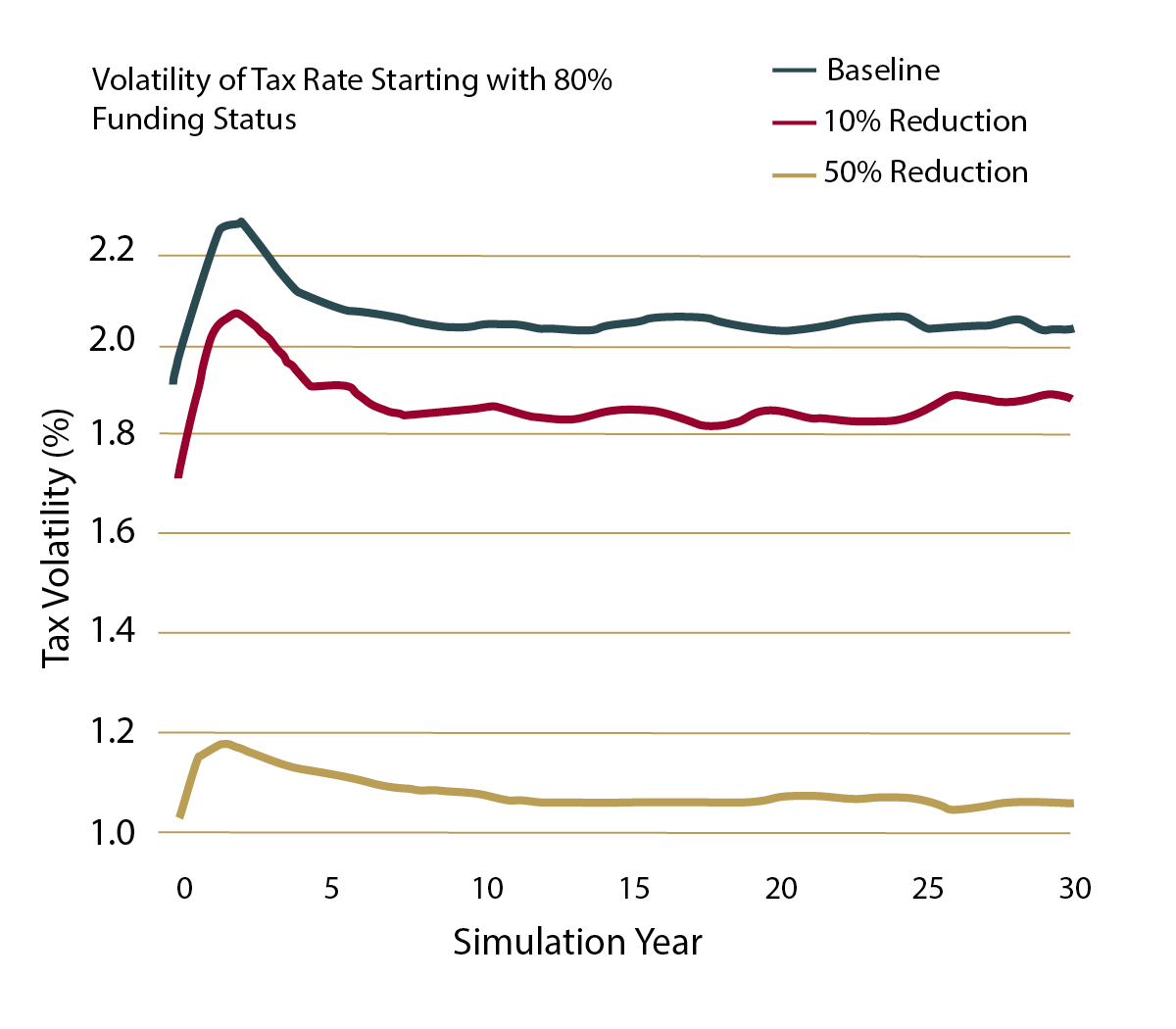

To assess the impact of a public defined benefit plan on taxpayers, the expected tax increase and the volatility of funding risk is found on a per-taxpayer basis. The expected tax increase is due to the higher wage paid to public employees, while the volatility of funding risk represents an additional risk exposure for each taxpayer. Exhibits 2 and 3 show the effect of reducing the level of the guaranteed benefit by 10% and 50% respectively. These are compared with the baseline case of no change in taxes and benefits. As expected, reducing the level of the guaranteed benefit increases the average level of taxes, but also reduces the level of tax volatility. The average level of taxes increases because wages must increase sufficiently to keep public workers indifferent between the DB and DC system. Tax volatility decreases because taxpayers are underwriting lower levels of market risk exposure.

Now the lifecycle portfolio problem for each taxpayer is almost the same as before: the taxpayer receives wages (with some risk), invests in financial markets (with some risk), and underwrites public sector pension funding (with risk). Just as with beneficiaries, the output is savings rules and investment glidepaths.

WHAT HAPPENS TO TAXPAYERS?

A simple policy experiment illustrates the effect on taxpayers of underwriting insurance for public employee defined benefit plans. To simplify, imagine two pools of 20-yearold workers at the beginning of their working lives. One pool works in the private sector and pays taxes. The second pool works in the public sector and receives a guaranteed retirement income (i.e. a defined benefit plan).

The policy question is whether private sector workers would be willing to increase compensation to public sector workers in exchange for the public workers shifting to a DC system. Since the interest is in the impact on the taxpayer, the public sector wage increase should be set so that the public employee is indifferent between the two plans.₉ To further simplify the analysis, it is assumed that the government increases taxes when the pension is underfunded. It is also assumed that pension funding surpluses are put to other purposes.₁₀

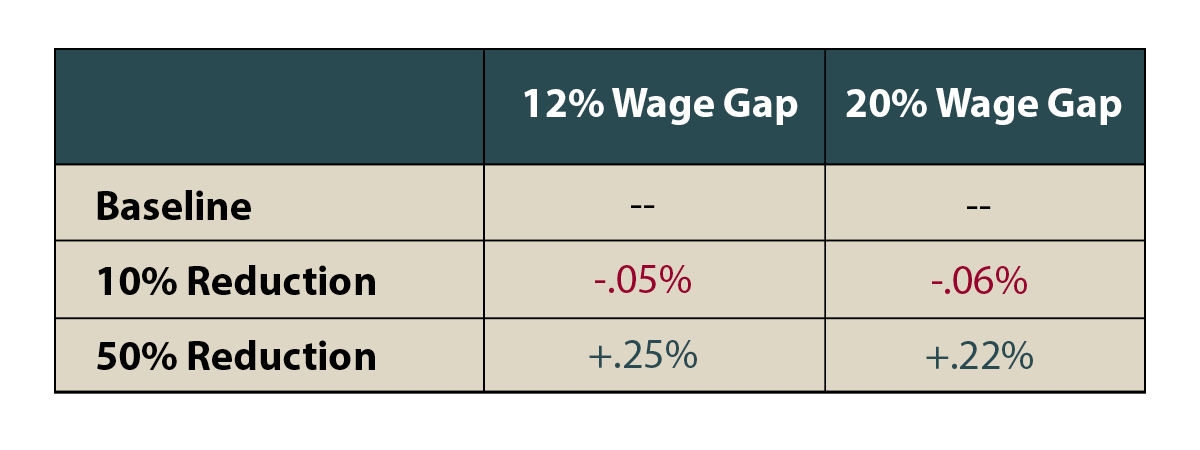

Taxpayer welfare changes when the insurance provision is eliminated. These changes are driven by changes in savings behavior and changes in the investment policy. The impact of policy changes on these quantities depends on the wage differential between the two pools and the level of the guaranteed retirement income. Exhibit 4 summarizes the impact of the policy change.

What matters to taxpayers is the impact of the policy change on economic welfare. Exhibit 4 shows the percentage change in welfare for taxpayers relative to the base case of a DB plan for public employees. In this stylized example, taxpayers lose when the reduction in the guaranteed benefit is modest (10%), but gain when the reduction is more significant (50%). When the guaranteed benefit reduction is higher, taxpayers face a higher certain wage tax, but lower tax volatility. The net effect is to improve taxpayer welfare.

This analysis has abstracted from important points such as demographic change, the composition of the labor force, and the structure of the government funding policy. Moreover, this analysis has assumed that the DC option for public employees uses these optimal savings and investment rules. These caveats notwithstanding, this analysis suggests that taxpayer welfare can improve when some fraction of the public employee DB plan is replaced by a DC plan. It bears reiterating that this analysis assumes that wage increases for public employees are sufficient to keep their welfare constant.

POLICY IMPLICATIONS

This policy brief quantifies the effects of taxpayers guaranteeing retirement benefits to public employees. The brief frames the discussion as a lifecycle portfolio choice problem. This analysis shows that taxpayers are funding two types of insurance for public employees - the first is a post retirement annuity, and the second is insurance against negative moves in financial markets during working years.

This stylized example starts by finding a wage increase that makes public employees indifferent between DC and DB plans. However, taxpayers are not indifferent to the policy choice. The analysis, which focuses on young workers, finds potential gains to taxpayer welfare when a DC plan is used instead of a DB plan. Those welfare gains depend on (1) the level of the income guarantee, and (2) wage differentials between public and private employees.

A key element in the analysis is the commitment of the government to a pension system funding strategy, which will be explored in a future brief.

1 PIOnline, August 6, 2018, referencing a study done by Milliman.

2 Most public pension systems are defined benefit, with a fixed benefit payment. Other choices are a defined benefit system with a flexible benefit; a defined contribution system, or a hybrid system.

3 According to the Bureau of Labor Statistics (BLS) roughly 17% of private sector workers had access to either a full or partial defined benefit plan (March 2018). By contrast, between 75% (according to the BLS) and 85% (according to CNN Money: Ultimate Retirement Guide) of public sector workers have access to a defined benefit plan.

4 Investment vehicles are available for most of the components in this structure. For example, Target Date Funds (TDF) for the investment glidepath, and annuities for post-retirement income are both commercially available. While specific vehicles are not yet available to hedge market risk near retirement, the building blocks (liquid futures markets) are available.

5 The BLS reports that 75% of public workers have access to a defined benefit plan. CNN Money Ultimate Guide to Retirement reports that the percentage of public employees with defined benefit plans is around 85%.

6 Many discussions of public defined benefit plans make a distinction between the employee and the employer contribution to the pension. From the taxpayer’s perspective, this is irrelevant. The taxpayer is paying the whole bill regardless of how it is divvied up.

7 The pension will be underfunded (or overfunded) when the value of invested assets is less than (or greater than) the value of current and future pension benefits. The valued of invested assets depends on asset market returns.

8 It is easy to imagine policies that defer increasing taxes when there are funding deficits, or that increase benefits when there are funding surpluses.

9 In other words, economic welfare is constant.

10 This assumption abstracts from actual policy. The next policy brief explores the impact of alternative pension funding policies.

AUTHORS:

KURT WINKELMANN is a Senior Fellow at the University of Minnesota where he leads the Heller-Hurwicz Economics Institute’s Pension Policy Initiative. He is also founder and CEO of Navega Strategies, LLC. Prior to starting Navega, he was Managing Director and Global Head of Research at MSCI and a Managing Director at Goldman Sachs Asset Management. Kurt earned his Ph.D. in economics at the University of Minnesota, and is the chair of the Heller-Hurwicz Economics Advisory Board.

JORDAN PANDOLFO is a graduate student in the Department of Economics at the University of Minnesota.