POLICY BRIEF: Public Pension Reforms Can Improve Economic Welfare

KEY POLICY INSIGHT: Using the model developed in earlier briefs, the welfare consequences of Rhode Island’s recent pension reforms are analyzed. This stylized example suggests that Rhode Island-style pension reform can improve economic welfare for both taxpayers and beneficiaries. In this example, the gains in welfare accrue most heavily to the young cohort of public employees and taxpayers.

BALANCING TAXPAYERS AND BENEFICIARIES

Public pension reform has been under discussion in many states recently.₁ This topic has been of interest because many public pensions are underfunded.₂ These discussions are controversial, in part because most proposals for pension reform include the substitution of a defined contribution (DC) system for the existing defined benefit (DB) system. Public employees have been asked to trade a known, and guaranteed, retirement income for one that depends on their own investment decisions.

In earlier briefs, the impact of pension reforms on public employees and on taxpayers were examined. Those briefs have shown how switching from a full DB to a full or partial DC system can be beneficial for both public employees and taxpayers. This assessment was based on a measure of economic welfare.

(b) increase the benefits for taxpayers; and

(c) increase the benefits for all younger workers.

A STRUCTURE FOR ANALYZING PENSION REFORM

The goal in analyzing pension policy reform is to assess the impact on taxpayers and beneficiaries of changes in public pension policy. Thorough analysis relies on the following underlying data:

• The age distribution of workers for private and public employers

• Wage processes (annual growth rates and standard deviation of growth)

• Public worker retirement benefit as a percentage of final salary

• Defined benefit funding ratio, pre-reform

• Characteristics of the policy reforms

• An assumption about the government’s funding policy

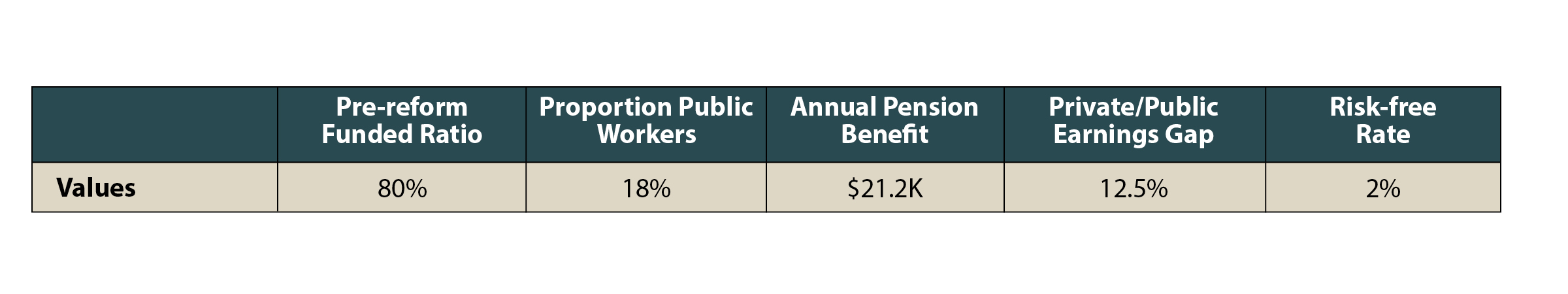

This brief considers the impact of pension policy reforms in Rhode Island. Exhibit 1 shows the base level of assumptions used for this analysis. As the exhibit illustrates, the starting point was an assumption that the DB plan was 80% funded and that private sector wages are (on average) 12.5% higher than public sector wages. Both of these assumptions can be tailored to state-specific data.

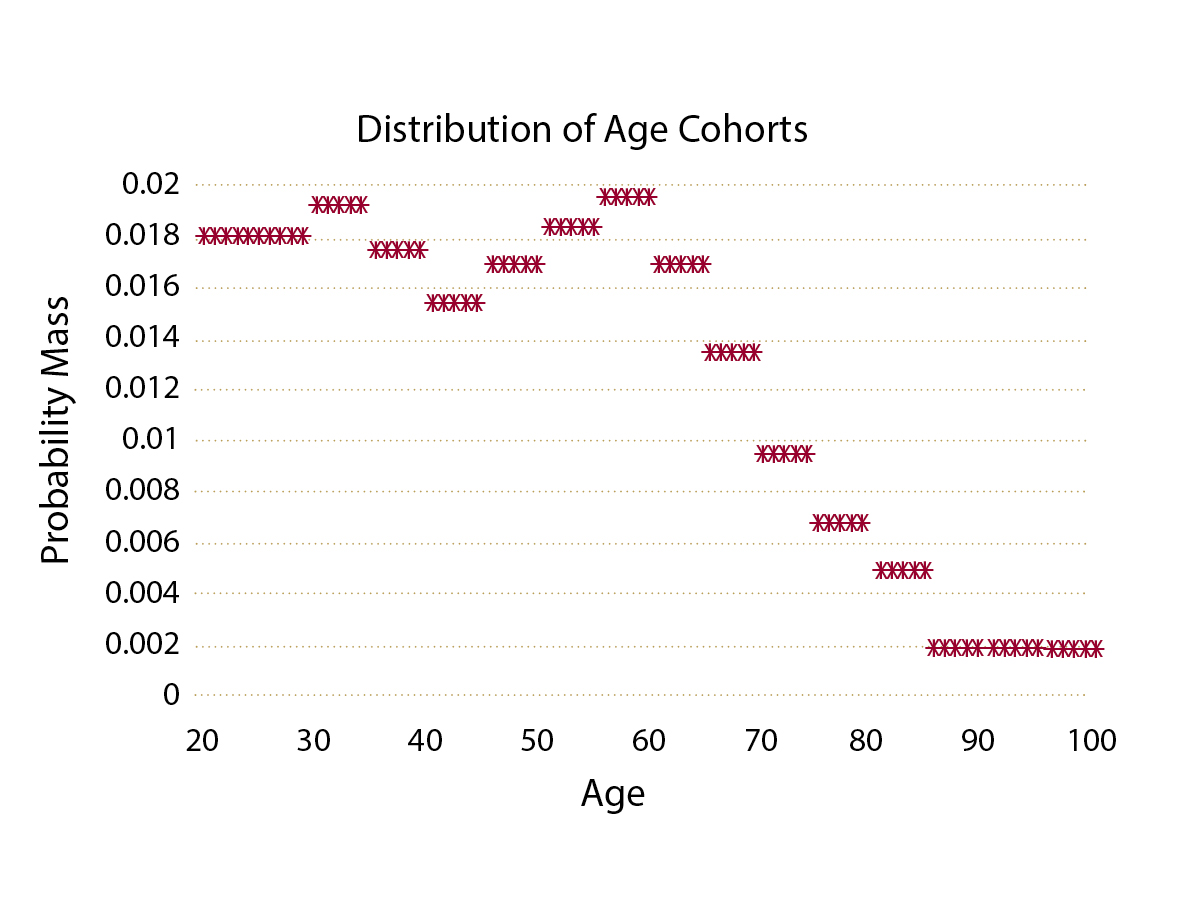

Exhibit 2 shows the assumed age distribution of workers. For this analysis, no distinction was made between public and private workers in each state. As is evident from the exhibit, there is a bulge of workers in the mid-to-late career cohort, relative to the younger cohort.

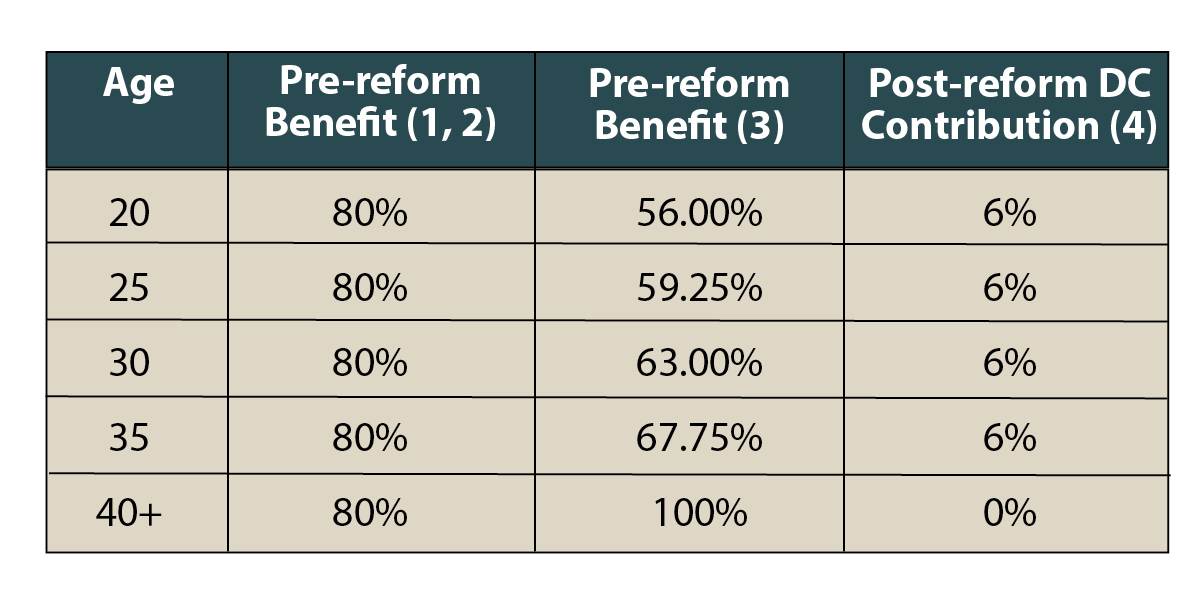

• All new public employees receive some form of a hybrid defined contribution plan. New public employees receive approximately 50% of the old DB plan and a DC plan.

• Cohorts with between zero and 20 years of experience receive a blend of the old DB and the new DC plan, with the exact blend following a specific rule.

• All participants in the new hybrid DC plan receive an increase in compensation. The level of the increase depends on the whether the old DB plan is still applicable. Eligible workers receive a 6% increase in compensation that must be applied to the DC program.

1. The retirement benefit is 80% of best five years salary.

2. Employees are assumed to work their entire careers in the system.

3. The post-reform benefit is a percentage of the pre-reform benefit.

4. Seen as compensation increase.

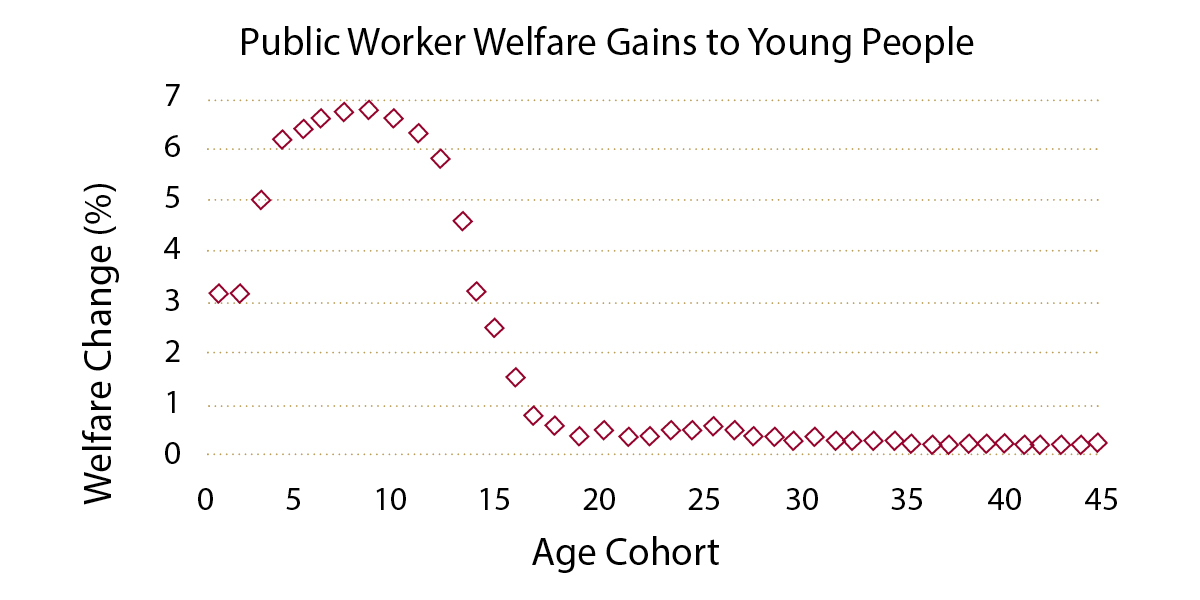

Exhibit 4 shows the impact of reforms on beneficiaries. In Rhode Island’s case, public employees with over 20 years of experience see no change in welfare, principally because the reform isn’t applicable to them. All other cohorts gain in this example. However, the benefits of the reform are most significant on the younger cohort.

Why do younger public employees gain from the reforms? The reform is designed to increase compensation to public employees. The increased compensation is dedicated to investing in retirement through a DC program. The young cohort has a long career ahead of them, thus, they also have a long time period to accrue the benefits from investing in equities.

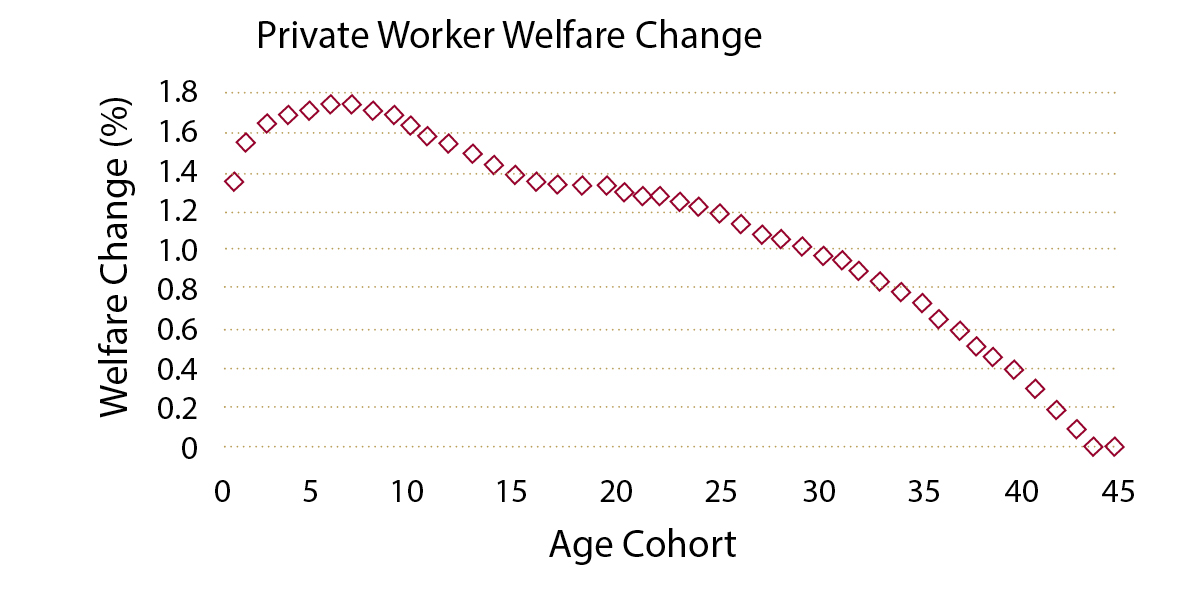

What about taxpayers? Exhibit 5 shows that taxpayers can also gain. Again, most of the benefits of reform accrue to young taxpayers. In this simple policy analysis, taxpayers gain because they are underwriting less insurance against adverse market moves.₇ They are willing to pay higher wage compensation in exchange for less potential tax volatility. In particular, younger taxpayers seem to gain more from the reforms than older taxpayers. The differences in the welfare gains between age cohorts is in part because with the passage of time, fewer public employees will have access to a defined benefit plan.

This policy analysis suggests that this type of policy reform succeeds by increasing compensation to public employees; investing the increased compensation in a DC program, and introducing a specific type of investment vehicle. These reforms have the effect of introducing the potential for some variability in retirement consumption, but also reduce the amount of risk that taxpayers underwrite. This analysis has been conducted using the types of structures and vehicles that are currently available. However, it is worth pointing out that other regulatory structures and investment options could achieve the same end results.₈

• State-specific age cohorts

• Differences in wage processes within private workers

• Benefit accrual processes in public plans

• The structure of state and local taxes

• The impact of economy-wide shocks on public and private worker wages

These caveats notwithstanding, this model as it stands provides an internally consistent framework for evaluating the impact of public policy on pensions. In addition to its applicability to public pensions, this framework is suitable for evaluating policy choices that affect private workers.

1 A recent article in Forbes highlights the role for reform. See “State Pension Plans Are In Bad Shape But Reforms Can Help,” Forbes, March 27, 2019.

2 See, for instance, “The Next Retirement Crisis: America’s Public Funds,” in Forbes, October 22, 2018.

3 We would expect more significant differences in the wage processes, both across states and within the private sector. We have left this as a subject for future research.

4 Consumption and Portfolio Choice over the Life Cycle”, Joao Cocco, Francisco Gomes and Pasal Maenhout, the Review of Financial Studies, Summer 2005

5 Target date funds adjust the mix between bonds and equities as a function of the investor’s age. An alternative is a balanced fund. This type of fund keeps the mix between bonds and equities constant.

6 We measure economic welfare as the discounted value of the expected utility of consumption (spending) across an investor’s lifetime.

7 Discussed in an earlier brief.

8 For an example, consider the collective DC structure that is in place in countries such as the Netherlands.

AUTHORS: