RESEARCH SPOTLIGHT: Entry Timing, Switching Costs, and Grocery Delivery Platforms

Grocery delivery services have seen rapid growth in recent years, a trend which has accelerated during the COVID-19 pandemic as consumers sought ways to navigate stay-at-home orders and to minimize risk of possible exposure to the virus.

Yet before COVID-19 became a term in our daily vocabulary, the online grocery market was experiencing significant growth as consumers embraced the convenience and time savings of the service. This growth occurred as large brick-and-mortar retailers such as Walmart and Target made large investments, and new digital platforms such as Instacart, Google Express, Prime Now and Amazon Fresh entered the U.S. market. This market sector provided graduate student Vitoria R. de Castro a rich topic for her research.

Most firms offer subscriptions, and data show that consumers rarely switch between them. Consumer inertia is a powerful force, as de Castro notes. “Switching patterns show that consumers rarely switch between services offered by different firms. In over 98% of purchases, consumers choose to use an alternative they have used recently.”

In her job market paper, de Castro uses the grocery delivery sector to examine switching costs and how firms make strategic entry decisions, considering both the incentive to lock in consumers with subscriptions before their rival and the costs of operating in different geographical markets.

Using rich data from a variety of sources, including the Nielsen Consumer Panel, de Castro studies entry timing and the impact of strategic mergers (for example, the acquisition of a grocery chain by a big tech firm). She explains:

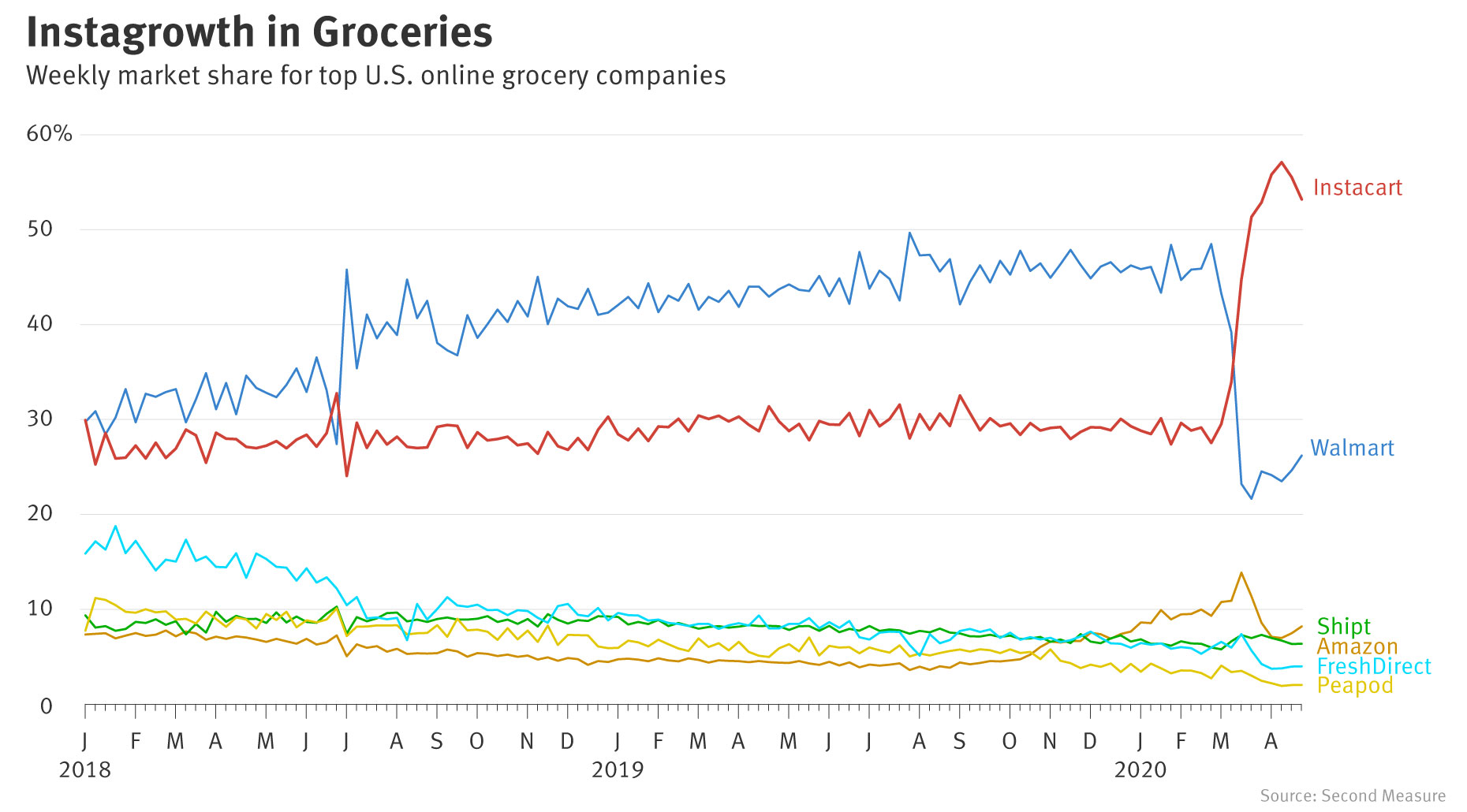

“In the paper, I study how firms with different business models have different strategies they can use to enter new markets. With COVID, these differences in strategies and how they relate to costs are even more apparent as firms had to expand quickly to respond to the sudden surge in demand for delivery. We can look at recent data, in the chart below, to see this: the firm with low entry costs was the big winner of the pandemic, gaining more new customers than the big firm with high entry costs or any other competitor. This is potentially due to its flexible business model that allowed it to grow quicker and meet this sudden increase in demand.”

The model developed by de Castro provides a useful setup for both demand- and supply-related questions relevant for current antitrust policy discussions around digital platforms in markets where geography also affects costs and competition.

During her time at Minnesota, Vitoria has been recognized with numerous awards and fellowships, including the Distinguished Teaching Assistant Award, the Leonid Hurwicz Fellowship, and the Estudiar con Esperanza Fellowship. After completion of her PhD, Vitoria will be joining Keystone Strategy in New York City as an economist and consultant.