POLICY BRIEF: Good Pension Fund Governance

The pension funds in South Dakota and Wisconsin have long track records of fiscal solvency. They have achieved this by maintaining contributions to the pension system, and by incorporating a degree of rules-based benefit flexibility. These steps were facilitated by a legislative commitment to full funding. The experiences of these states offer important lessons for would-be pension reformers.

INTRODUCTION

This policy brief continues our discussion of the importance of long-term policy commitment to public pension solvency. We apply the lessons learned from our earlier briefs to discuss two public pension success stories- the states of South Dakota and Wisconsin. Our conclusion is that statutory structures in these states support commitment to policies that promote long-term funding stability.

Our earlier briefs traced persistent underfunding of public defined benefit to failures to both meet the Annual Required Contributions (ARC) and achieve long-term return targets. In our model-based examples, the more important of these is the failure to meet the ARC. We argued that the root cause of these failures stems from a combination of balanced budget requirements, quirky accounting standards and constitutional protection of pension benefits. In some respects, this combination almost guarantees underfunded public pensions.

Wisconsin and South Dakota stand out as counterexamples, as both states have shown long-term commitments to funding solvency. Although the specific mechanisms vary between states, the main elements have included statutory requirements to pay the ARC, and flexibility in retirement benefits. These mechanisms have helped each state achieve funding solvency despite the underperformance of investment returns relative to their targets. The examples suggest to us that pension reform should be accompanied by careful consideration of whether and how the state can credibly commit to long-term policies post-reform. Reform without commitment isn’t reform.

LONG TERM RECORDS OF FISCAL STABILITY

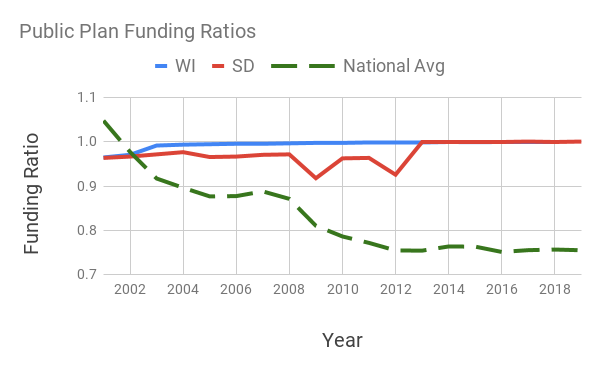

Over the past 20 years, the pension systems of South Dakota and Wisconsin have routinely been fully funded. This point is illustrated in Exhibit 1.(1) With the exception of the three-year period surrounding the Global Financial Crisis (GFC) of 2008, funding ratios in each state have been approximately 100% for the entire period.

How have each of these states been able to achieve fiscal stability when other public defined benefits systems failed? Our earlier brief pointed towards the importance of commitment to paying the ARC and meeting investment return targets. That brief also alluded to, but did not explore, benefit flexibility as another tool.

ROLE OF INVESTMENT PERFORMANCE

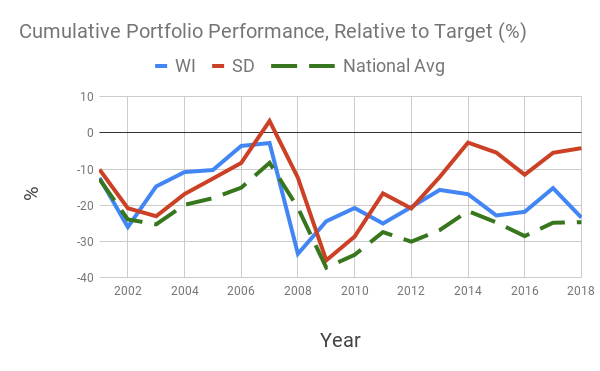

In South Dakota and Wisconsin, the main tools for maintaining fiscal solvency have been paying the ARC and benefit flexibility. One reason for this is that each state’s investment portfolio did not achieve its return target. This point is illustrated in Exhibit 2. The exhibit plots the cumulative performance of the investment portfolio relative to the performance at the target return.

The exhibit covers the period from 2001 to 2018. Several points are evident from the exhibit. First, it is clear that that each fund’s investment performance undershot the target in virtually every year. Second, each fund’s performance was dramatically affected in the Global Financial Crisis of 2008. Third, the cumulative differences seemed to track quite closely until 2013, when South Dakota’s fund seemed to perform better than Wisconsin’s. Thus, the failure to meet investment return objectives placed added pressure on the other two levers for pension fiscal policy: commitment to paying the ARC and benefit flexibility.

COMMITMENT TO CONTRIBUTING THE ARC

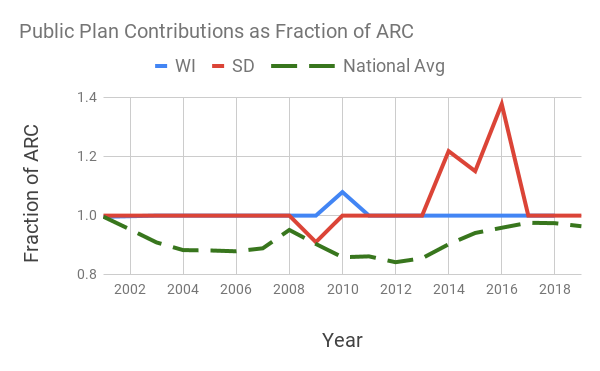

Exhibit 3 shows the history of pension contributions for both Wisconsin and South Dakota. The graph covers the period 2000-2018. Again, with the exception of the period surrounding the GFC in 2008-09, both systems routinely contributed at the required level. The exhibit also shows that the adverse investment losses in 2008 (illustrated above) were compensated for by over-paying the ARC the following year. While both states have met their ARCs, the actual mechanisms for doing so have been different.

In Wisconsin’s case, by statute the plan originally required employers to fully contribute at the ARC level.(2) This statute was modified in 2011 to require that the annual contribution be equally split between employers and employees. The impact of this change was to share the risk of pension funding between taxpayers (employers) and employees.(3)

The commitment mechanism is different in South Dakota. In this case, by state law the South Dakota Retirement System must recommend changes in pension policy to the legislature should the funding ratio fall below 100% and/or if current contributions are insufficient to meet pension benefits. The pension reforms in 2011 and 2017 were triggered by these conditions. These reforms focused mostly on changes in benefit payments and less on contributions, and will also be discussed below.

FLEXIBLE REQUIREMENTS REDUCE TAXPAYER RISK

The second channel used in both states to maintain pension plan fiscal stability has been adjustments in pension benefits, albeit with different specific mechanisms. Let’s look at them in turn.

For Wisconsin’s beneficiaries, employees accrue assets during working years. Retirement benefits are flexible: the beneficiary’s annual payment varies with actual investment returns and any contribution needs for the fund. When fund investment returns are poor, or when the fund is underfunded, then retiree benefits decrease, and vice versa. Regardless of the accumulated value of assets, employees now face some risk to retirement income. In a sense, this structure can be viewed as a form of a variable annuity.(4)

In South Dakota, the main mechanism used to introduce payment volatility was to change the rules on Cost-of-Living- Adjustments (COLAs). Prior to the reform of 2010, COLAs were fixed. The 2010 reform introduced a floor and a cap to the inflation adjustment, contingent on the funded ratio of the plan. If the funded ratio was below 80%, then the COLA was limited to 2.1%, while if the funded ratio was above 110%, then the COLA was capped at 3.1%. The caps and floors on COLAs were further refined in 2017, with a lower floor and higher cap, again with triggers defined by the funded status of the plan. The 2017 reform also lengthened the time period used to define retirements from the last three years of employment to the last five years. This reform has the effect of reducing expected retirement income and hence the value of projected pension obligations.(5)

LESSONS FOR WOULD-BE PENSION REFORMERS

In an earlier brief, we discussed investment and retirement income choices when consumers do not have a guaranteed retirement income. We showed that in that circumstance, retirement income looks much more like a variable annuity. A subsequent brief applied the same framework and showed that when retirement income is guaranteed to public employees, taxpayers underwrite the potential risk of underfunded public pension plans. In a third brief, we showed how accounting rules and constitutional balanced budget requirements can produce incentives to underfund public employee pensions.

The examples in this brief suggest that states with variable benefits are better able to commit to funding solvency. They are able to do so because the variable benefit has the potential to reduce the required contribution. In our opinion, the most important lesson for would-be pension reformers is that the ability to commit to long-term pension solvency rests on stable contributions. Given the real constraints on state budgets, introducing variable retirement benefits seems to be an important mechanism for achieving this goal.

1 Data for all exhibits from Public Plans Data from the Center for Retirement Research at Boston College (CRR) and the Center for State and Local Government Excellence (SLGE).

2 A good discussion of the Wisconsin plan can be found in https://reason.org/commentary/the-wisconsin-retirement-system-i….

3 The 2011 reform did not increase employee compensation. Thus, the contribution split had the effect of reducing state tax volatility at the expense of lower after-tax, after-benefit compensation for employees, implying a decrease in employee expected economic welfare. The point of this brief is not to defend this policy, but rather to point out the mechanisms used in Wisconsin.

4 See the discussion in the Reason Foundation note.

5 As in the case of Wisconsin, the South Dakota reforms in 2010 and 2017 did not increase employee compensation. Both the COLA caps and floors, and the lengthening of the time period used to calculate retirement income have the effect of reducing beneficiary economic welfare.

AUTHORS

Kurt Winkelmann is a Senior Fellow at the University of Minnesota where he leads the Heller-Hurwicz Economics Institute’s Pension Policy Initiative. He is also founder and CEO of Navega Strategies, LLC. Prior to starting Navega, he was Managing Director and Global Head of Research at MSCI and a Managing Director at Goldman Sachs Asset Management. Kurt earned his Ph.D. in economics at the University of Minnesota, and is the chair of the Heller-Hurwicz Economics Advisory Board.

Jordan Pandolfo is a graduate student in the Department of Economics at the University of Minnesota.