POLICY BRIEF: Pension Policy Reform - A Summary

I. Introduction

This brief summarizes the policy analysis results of our previous three briefs. Our analysis builds on our work over the past three years. Earlier briefs argued that since the main source of public pension fiscal challenges broadly relate to governance, then pension reform without governance reform is not, in fact, reform.

The reform considered here addresses governance through a structure to bring predictability (not stability) to pension contributions and retirement income. The idea of predictable, but not fixed, contributions and retirement income lies behind the fiscally solvent public pension systems such as Wisconsin and South Dakota.

The specific reform we consider substitutes a DC plan for the traditional DB plan for new hires. We choose this example not as a proposal, but rather because it represents the most extreme example of the concept of variable contributions and retirement income. Further, we analyze the implications of alternative methods for financing the deficit in the legacy DB plan.

As with any policy, the results of our analysis depend on specific policy choices. Our goal in this brief is not to propose a specific policy reform, but rather to illustrate how a specific analytic framework can be used to consistently evaluate tradeoffs across multiple constituencies.

II. Policy Levers and Constituents

Since our goal is to evaluate the tradeoffs associated with policy reform, we start by identifying the main constituencies affected by any reform. Our earlier brief identified the five main constituencies as:

- Retired public workers

- Current public workers

- New hires to the public sector

- Taxpayers

- Future generations

Our earlier briefs suggested that policymakers have a limited number of options. The policy levers that we consider are:

- Reduce or eliminate the COLA

- Eliminate any potential for unexpected benefit increases

- Close the DB plan to new entrants and replace with a DC plan

- Commitment to paying the ARC at alternative levels

- Determining the proportion of contributions paid by employees versus taxpayers

The impact of each of these policy changes is considered relative to a do-nothing scenario. We measure the impact of these policy changes on each of our constituents by looking at the economic welfare (or “expected utility”) of the path of consumption expenditures. We choose this metric because it best reflects the impact of policy choices on savings and investment decisions across time.

III. Assumptions for Our Experiment

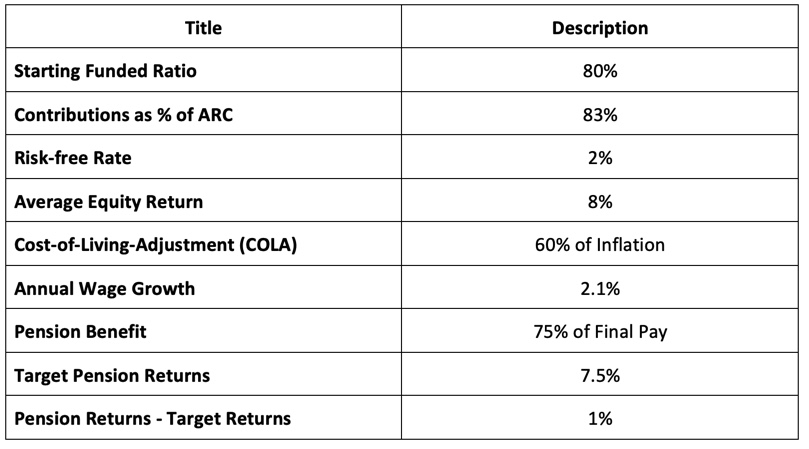

We have two types of assumptions. The first type is those that are held constant across all analyses, while the second type is assumptions that we allow to vary across analyses.

For current workers and retirees, we assume that the cost of living (COLA) to retirement income is 60% of actual inflation. Furthermore, we assume that optional benefit increases are eliminated (e.g., no 13th check). As documented in our earlier briefs, reducing the COLA for public workers (a) reduces public worker welfare; (b) increases taxpayer welfare and (c) decreases the additional compensation necessary for new hires to switch to the DC plan.

For new hires to the public sector, we assume that the DB plan is closed. New hires are assumed to be automatically enrolled in a DC plan that (1) imposes a savings rule with auto-escalation and (2) imposes an investment “glidepath” that automatically adjusts the mix between risky and risk-free assets. Both of these features are consistent with current best practices in US Corporate DC plans.

Finally, we set the level of total compensation (salary plus pension contribution) for new hires so that the worker is indifferent between the new DC plan and the legacy DB plan. In our analysis the worker is actually paid the level of total compensation, not just the salary. The reason for this assumption is because it (in principle) binds the employer to make the pension contribution. This assumption stands in contrast to the current DB structure, where state budget directors have options that allow them to avoid making full pension contributions.[1]

In addition to the fixed assumptions, we analyze two specific types of policies under variable assumptions. The first policy looks at alternative commitments to paying the ARC. In this case, we consider three policies: (1) maintaining the status quo (currently paying 83% of ARC); (2) fully paying the ARC, and (3) fully paying the ARC while also achieving the target returns.

The second policy concerns the split in contributions. In our baseline set up, contributions are split evenly between taxpayers and employees. In the cases of full commitment, we consider the consequences where all of the incremental contributions are paid by taxpayers versus where all of the incremental contributions are paid by employees (i.e., in the form of reduced take-home pay).

Exhibit 1 below summarizes our initial assumptions.

IV. Results

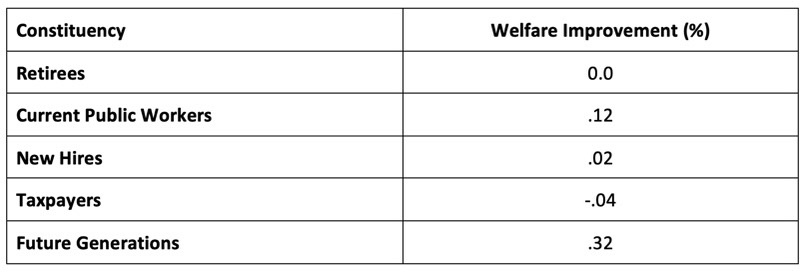

Exhibit 2 show the results of our policy analysis.[2] The exhibit shows the changes in welfare relative to the status quo, conditioned on both paying the full ARC and assuming that new contributions are split 50/50 between taxpayers and current public workers. As the exhibit shows, welfare improves for all constituencies except for taxpayers. The most significant improvements are experienced by future generations, as the level of legacy debt decreases when the full ARC is paid. Taxpayers suffer a welfare loss because of the increased tax liability to fund the pension deficit. Current public workers gain because the option value of potentially higher retirement benefits increases.

Qualitatively, the consequences of eliminating the option value of potentially higher retirement benefits are the following. First, current public workers would not see as dramatic an increase in welfare, if any at all. Second, taxpayers would experience a welfare gain, as (potentially) would new hires. The welfare gain for new hires would depend on whether the compensating wage were to be reduced.

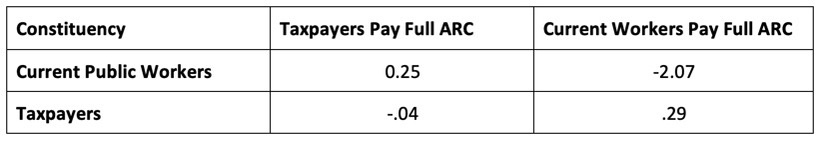

A second policy choice is whether the burden of commitment to paying the full ARC is borne by taxpayers or current public workers. The main constituencies affected by this policy choice are taxpayers and current workers. Exhibit 3 shows that when taxpayers pay the full incremental ARC, their welfare decreases further, while current public workers experience a welfare gain. Similarly, when current public workers pay the full incremental ARC, their welfare deteriorates and taxpayers improve. These results should not be at all surprising.

Although the qualitative results are not surprising, the benefit of our framework is that it puts each constituency on an equal analytic footing as every other constituency. The next section discusses alternative policies that can be analyzed within our model.

V. Alternative Policies and Open Issues

One policy change that is straightforward to analyze in our model is the effect of reducing COLAs. Qualitatively, reducing COLAs improves welfare for taxpayers (because real benefit payments decrease), and decreases welfare for retirees and current public workers. New hires experience a small decrease in welfare (because the compensating wage decreases slightly), while future generations are unaffected (paying the ARC is much more important, as it affects the legacy debt).

A second policy change that can be easily analyzed is the impact of reducing the target return. Lower target returns are more likely to be achieved, which is the prime benefit. The cost of lower target returns is an immediate increase in the ARC. Consequently, there is a reduction in taxpayer welfare. Future generations could see welfare improvements, contingent on whether the full ARC is paid and whether the new, lower target returns are actually achieved.

The preceding two examples maintain the assumption that new hires are given a DC plan. Other policies can be treated in the model as well. For example, we can easily evaluate hybrid systems (e.g., Rhode Island), fully funded systems with variable savings and retirement income (e.g., Wisconsin), collective DC plans (such as in the Netherlands), or a model that combines a variable annuity with a DC plan. Each of these types of policies can be accommodated within our framework. It is even possible to identify combinations of policies that balance welfare changes across constituencies.

There are policy issues and other questions that this framework cannot immediately address. Obvious examples are those questions that involve (a) the impact of large macro shocks on state budgets or (b) employee preferences for public versus private sector employment.[3] Both public union and elected official should consider adding these extensions to our framework.

VI. Conclusions

Our goal in this brief was to illustrate how our framework can be used to evaluate the impact of pension reform across multiple affected constituencies. We based our analysis on the insights gained from the lifecycle portfolio choice model. We chose this specific approach because it gave us a set of measurements that can be consistently applied to each constituency.

The reform scenario that we considered as an illustration was one that (a) resolved many of the issues surrounding commitment to pension contributions and (b) introduced “predictable variation” in contributions and retirement income. Our example was chosen not to illustrate a specific policy, but rather to show how an analytic approach can be applied. The example we considered can be applied to many other types of pension reforms. Because our framework can analyze a wide range of potential pension reforms across multiple constituencies, we believe that it offers policymakers a viable structure for evaluating pension policy tradeoffs.

AUTHORS

Kurt Winkelmann is a Senior Fellow at the University of Minnesota where he leads the Heller-Hurwicz Economics Institute’s Pension Policy Initiative. He is also founder and CEO of Navega Strategies, LLC. Prior to starting Navega, he was Managing Director and Global Head of Research at MSCI and a Managing Director at Goldman Sachs Asset Management. Kurt earned his Ph.D. in economics at the University of Minnesota, and is the chair of the Heller-Hurwicz Economics Advisory Board.

Jordan Pandolfo worked as a graduate research assistant before earning a Ph.D. in the Department of Economics at the University of Minnesota.

[1] Here is how we are thinking about total compensation. Under the DB system, the worker is paid a salary (W) and the employer makes a pension contribution (C_EMPLOYER). The employer’s contribution is not necessarily fixed. The employee also makes a contribution (C_EMPLOYEE). Total compensation is W+C_EMPLOYER), and take-home pay is W-C_EMPLOYEE). For the DC plan, the worker is paid a total compensation, (TOTAL_COMPENSATION), from which a specific dollar amount is deducted and invested in the DC plan (DC_DEDUCT). Take home pay is now TOTAL_COMPENSATION-DC_DEDUCT. We choose the level of total compensation so the the new hire is indifferent between the two systems. Usually total compensation increases modestly. But, taxpayer volatility decreases, since there is more predictability in employer costs.

[2] Each entry in the table shows the average gain across age groups. Our earlier briefs show the distribution of welfare gains across age groups.

[3] The first question involves introducing (a) a state budget and (b) a long-run risk model with persistent shocks. To answer the second question, we would need to introduce a model of labor/leisure choice with the possibility of switching between each sector. Both are tractable, interesting and provide insight into a number of policy choices.