POLICY BRIEF: Revisiting Why Public Pension Reform is so Hard

Key Policy Insight

This brief shows how pension reform without a change in the rules-of-the-road is doomed to failure. For public pensions, policymakers can influence three main variables: the rate of contributions, the target return on investments, and the level of benefits. As distinct from other pension systems, policymakers are able to choose levels for these variables without explicit reference to market pricing. This ability, coupled with governance rules that require short-term balanced budgets, almost guarantee weak pension finances.

I. Introduction

Weak macroeconomic growth, induced in part by Covid-19, will raise significant issues for state Treasurers. High unemployment and low economic growth will produce budget deficits that will need to be financed. At the same time, Treasurers and legislatures will need to think through the knock-on effects of low growth and poor asset returns on their state pension systems.

In the aggregate, these systems are underfunded- they simply do not have enough money to pay the promised retirement benefits. According to data from the National Association of State Retirement Administrators (NASRA), these systems have been underfunded for the past 18 years. The macroeconomic and financial market crises of 2020 only exacerbated what was already a tenuous situation for many public pension funds.

As with past financial crises, this one is likely to prompt pension reform discussions. And, once again we can count on resistance to any such discussions. It will be claimed that it will all work out because these systems are designed for the long term.

In view of the uncertainties around restoration of economic growth and financial market stability, it is worth examining this claim. According to our analysis, the root cause of public pension funding woes is poorly designed governance. In fact, the rules governing public pensions are almost guaranteed to produce funding disasters. Ultimately, maintaining these rules is bad for both taxpayers and for public employees. Before we look at the root governance challenges, we’ll see how the long-term solvency claim stacks up against reality.

II. Mismatch Between Claims and Reality

The main driver of the long term solvency claim is that periods of pension deficit are offset by periods of pension surplus. Achieving this long-term balance in pension funding requires:

- Achievable initial assumptions about investment returns

- A demonstrated ability to reach those returns over a long time period

- A demonstrated ability to make required annual contributions

- Predictable benefit payments

This analysis focuses only on the asset return targets and the pension contribution rates. Unfortunately, over the past 20 years public pension funds have fallen short on both. Let’s look first at the ability to achieve assumed target returns.

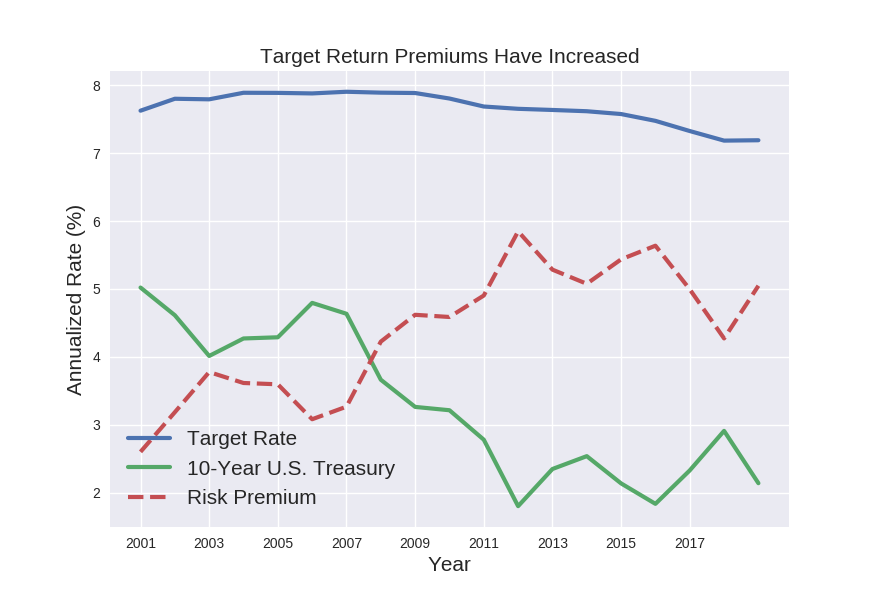

Over the past 20 years, US public pension funds have set aggressive targets and failed to meet them. This point is illustrated in Exhibits 1 and 2. Exhibit 1 plots the time series of the average target return for US pension funds. The exhibit also shows the difference between the target return and US 10-year Treasury bond yields (which can be taken as a proxy for the return on a risk-free investment). This difference represents a risk premium.

The governance of public pensions funds is set up so that they select the target return. However, market pricing sets bond yields. As the exhibit makes clear, although target returns have declined somewhat over the past 20 years, the premium for bearing risk has increased. Thus, the incentive for state investment teams is to take on more investment risk.

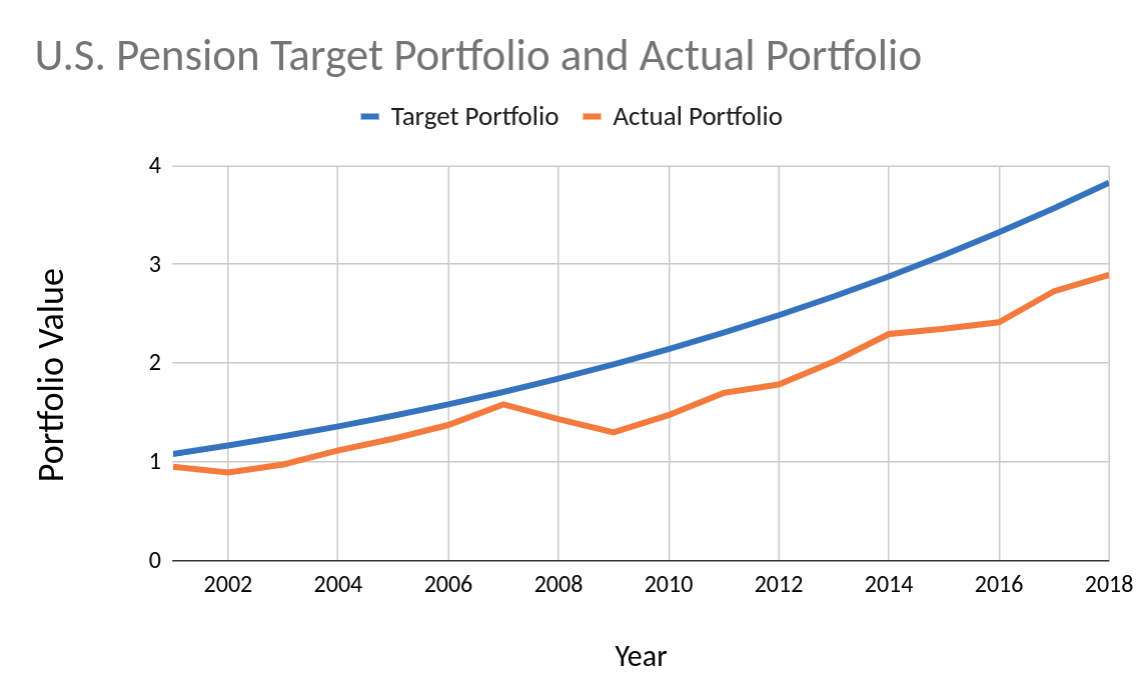

So, how have funds done in terms of meeting these target returns? Exhibit 2 plots the actual aggregate performance for public funds against an average of their target returns. Over the entire 18-year period covered here, the investment return on public funds has been 1.7% less than the average target return.(1) The exhibit shows that there were periods when public fund investment returns exceeded their targets. However, these periods were more than offset by periods with dramatic losses. Perhaps not surprisingly, the periods of dramatic losses were also periods of significant macroeconomic shocks and financial market stress.(2)

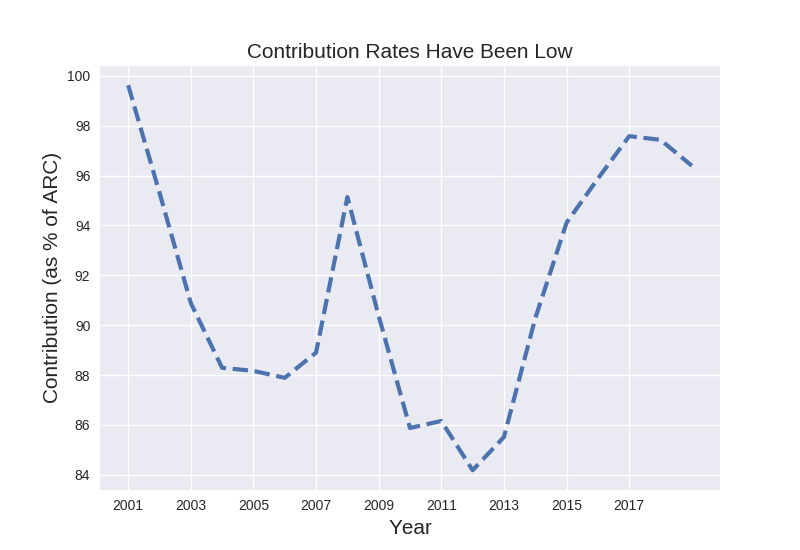

Failing to meet target returns is not necessarily a problem, provided that contribution levels are adjusted and met. Unfortunately, over the 18 years we studied, on average public pension systems have systematically failed to reach their funding targets as well. This point is illustrated in Exhibit 3. Similar to Exhibit 2, the most acute deviations from target contributions seem to have occurred during periods of macroeconomic and financial market stress.

To summarize, for the past 20 years public funds have:

- Provided incentives to take more investment risk

- Missed their return targets

- Missed their required contributions

These observations prompt three questions. First, what are the economic costs of maintaining the status quo. Second, what is the root cause of the situation, and third, how can it be resolved.

III. Avoiding Reality Has an Economic Price

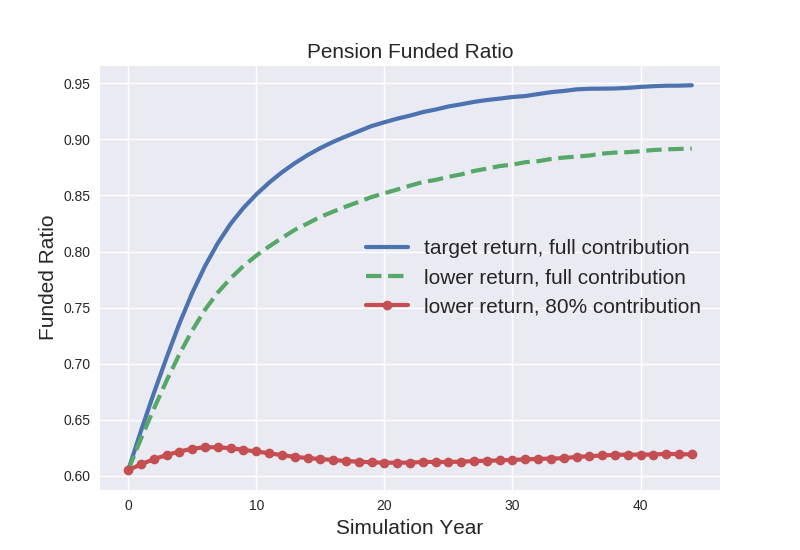

To understand the importance of investment returns and contributions to achieving long-run funding stability, let’s consider a simple example. For illustration, suppose that a pension fund has a funding ratio of 63% — that is, the fund has $63 to pay off $100 of future pension liabilities. Furthermore, suppose that the target return is 7.5%, and that the fund always achieves the target. Finally, suppose that the fund consistently makes contributions at the required rate. As shown in Exhibit 4, under these circumstances eventually the fund returns to solvency.(3)

Now let’s suppose that the fund makes contributions at the required rate, but that the actual investment returns are consistently 6.0% instead of 7.5%. As illustrated in Exhibit 4, under these circumstances the fund will remain insolvent, but its funding won’t deteriorate appreciably.(4)

Finally, suppose that in addition to lower returns, the fund only makes 85% of its annual required contribution. The exhibit shows that in this case, the fund is perpetually underfunded at the 63% level. In this case, there is no long-term return to solvency. Clearly, if current trends persist, then it is unlikely that pension solvency will be achieved.(5)

The consequences for taxpayers and beneficiaries of perpetual pension deficits are straightforward, and are driven by the requirement to balance the state budget. Holding pension benefits fixed, the only ways to resolve budget issues are to either raise taxes or reduce public services. Reductions in services can mean cuts in activities, public employee layoffs and salary freezes. For beneficiaries, long periods of pension underfunding has the potential to put a cap on any increases in future pension benefits.

IV. The Impact of the Rules of the Road

The examples in the previous section illustrate the risks associated with public pension funds. Assuming people were cognizant of these risks, we have to ask how exactly did we get here? Since nobody intentionally designs a pension system to go bankrupt, it is useful to look at the rules of the road governing state pension systems and state legislators. As it turns out, these rules impose real constraints on policy makers.(6)

The starting point is the accounting treatment of public pensions, i.e. the balance sheet (which measures the value of net assets) and the income statement (which measures flows over time). For private entities (households or private companies), the balance sheet shows the value of assets, the value of liabilities and the net surplus or deficit. Liabilities can be paid over time. For example, a homeowner who finances a home purchase with a mortgage will have assets (the house and, say, an investment portfolio) and a liability (the mortgage, whose payments occur over time). The household’s net worth is simply the value of all assets less the value of the mortgage liability. Net worth will vary over time with changes in the value of assets and liabilities. Private company balance sheets work in the same way. Thus, the value of the company depends on net revenue from operations and net indebtedness (including the net pension liability).

US public pension funds are different from private entities — the value of pension benefits to be paid in the future do not show up on the balance sheet. Thus, from an accounting perspective the pension liability is irrelevant to the net indebtedness of the state.(7) In practical terms all of the accounting incentives now shift to the income statement.

There are three main pension cash flows that are relevant to state budgets. The first is the actual pension benefit paid to retirees, the second is income from investments and the third is new contributions to the pension fund. Retiree benefits are often guaranteed and investment returns are driven by financial markets.(8) For state pensions, contributions are made by employees and the employer (state or local).(9) Consequently, the only pension cash flow that is directly under the control of a state Treasurer is the actual annual contribution paid. Because the contribution shows up on the annual budget, it will naturally collide with other budgetary demands.

Most states have constitutionally mandated balanced budget requirements.(10) These requirements are a constraint for legislators and imply that legislators are always forced into trading off the short-term interests of the pension fund (e.g. higher contributions) against other demands on state revenue. This budget tension is most acutely felt during periods of financial stress (e.g. 2008-9 and 2020). Moreover, since pension indebtedness doesn’t appear on the balance sheet, there is no accounting incentive to increase contributions. Therefore, legislators and state Treasurers have built-in incentives to focus on reducing pension contributions in favor of other spending needs.

Legislators and state Treasurers have two main mechanisms at their disposal to reduce contributions. First, they can simply maintain high target returns. Doing so decreases the value of pension benefits and hence the level of the required contribution. Second, they can simply choose to miss the required contribution, as there is no obvious legal requirement to do so. On balance, then, states have few, if any, incentives to either reduce the target rate of return or to maintain their required contributions.(11)

It is important to point out that public pension funds didn’t become underfunded because investment professionals necessarily did anything illegal. Rather, the discussion in this section better having an independent party set discount rates provides better governance and a more well-funded pension system. A logical place to look for an independent source is state insurance commissioners.

V. Where to From Here?

Would-be pension reformers would be well advised to address reform in the context of the actual legal structure for most states. The reality is that balanced budget requirements and constitutional protections are not likely to change any time soon. Given those constraints, here are two possible avenues for pension reform.

First, close the DB pension system to new entrants and replace it with a system that introduces some volatility in retirement income. The new system can be a collective DC system (similar to the Netherlands) or the DC system that is available to private workers. And, the new system can potentially include a lower guaranteed income (i.e. a hybrid DB/DC plan). Note that the system for new entrants may need to include a wage increase as a compensation for the loss of a guarantee.

Second, for the new entrant pension system, take the choice of discount rate out of the hands of legislators and state Treasurers. It is clear from other pension systems that having an independent party set discount rates provides better governance and a more well-funded pension system. A logical place to look for an independent source is state insurance commissioners.

Neither of these suggestions directly solve the problem of today’s underfunded public pension plans. However, by reducing budget volatility attributable to pension contributions, they make it possible for today’s systems to be less of a long-term burden. As discussed, when underfunded pension systems reach their required returns and achieve their required contribution rates, they can restore solvency (provided the horizon is long enough).

Any discussion of pension reform should keep in front-of-mind that a vibrant private sector and a healthy public sector are complementary. For this point to work, taxpayers should not be faced with the uncompensated risk of undue tax volatility and/or service disruption. And, at the same time public employees should be fairly compensated (including retirement security). The rules of the road governing today’s public pension system almost guarantee failure on both of these points. Pension reform must be accompanied by changes in governance.

AUTHORS

KURT WINKELMANN is a Senior Fellow at the University of Minnesota where he leads the Heller-Hurwicz Economics Institute’s Pension Policy Initiative. He is also founder and CEO of Navega Strategies, LLC. Prior to starting Navega, he was Managing Director and Global Head of Research at MSCI and a Managing Director at Goldman Sachs Asset Management. Kurt earned his Ph.D. in economics at the University of Minnesota, and is the chair of the Heller-Hurwicz Economics Advisory Board.

JORDAN PANDOLFO is a graduate student in the Department of Economics at the University of Minnesota.

CAMERON BRUMMUND worked as an undergraduate research assistant before earning a Bachelor of Science in the Department of Economics at the University of Minnesota.

1 The portfolio returns were taken from the Center for Retirement Research’s Public Plans database. This database shows the smoothed geometric average return for all of the public pension funds in their sample. We refined the analysis by selecting only those found who were listed in the NASRA report of 2018. Using the geometric average leads to a lower average return than taking a simple average. Smoothing reduces the annual volatility, as is evident from the exhibit.

2 Even when smoothing is introduced we still see a failure to meet long term target returns.

3 The simulations in Exhibit 4 rely on a model that incorporates demographic characteristics and accounting conventions. The specific results will depend on assumptions about both of these, and our model is flexible enough to incorporate these differences. However, the general points remain the same.

4 The reason the funded ratio continues to increase is because the required contributions will always increase to compensate for the lower investment returns.

5 In this example, should funding drop below 85%, then the funded status will deteriorate further.

6 Beerman (2013) and Monahan (2015) have a good discussion of the legal constraints imposed on state legislators.

Beerman, J.M. (2013). The Public Pension Crisis. Washington and Lee Law Review.

Monahan, A.B. (2015). State Fiscal Constitutions and the Law and Politics of Public Pensions. University of Illinois Law Review.

7 Fitzpatrick, T.J. and Monahan, A.B. (2015). Who’s Afraid of Good Governance? State Fiscal Crises Public Pension Underfunding and the Resistance to Government Reform. Florida Law Review, 66.

8 See Monahan (2010) for a discussion of which states have state constitutional guarantees on pension benefits.

Monahan, A.B. (2010). Public Pension Plan Reform: The Legal Framework. Education, Finance and Policy, 5(4).

9 Economically, the split between employer and employee contribution is a fiction, as total compensation is the sum of wage income plus pension contributions (regardless of source).

10 State balanced budget requirements have a long history. See Monahan (2015) for a discussion.

11 The flexibility afforded US state pension plans differs from other pension systems. As a specific example, US Corporate DB plans are legally required to restore full funding. Pension systems in other countries (e.g. the Netherlands) have similar requirements.