Litterman is optimistic incentives can put the brakes on climate change

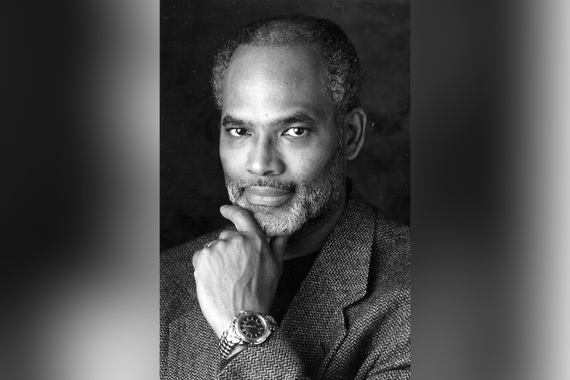

On November 1, Robert Litterman (PhD ‘80, economics) was the featured presenter at the Heller-Hurwicz Economics Institute Fall Lecture, during which he was officially awarded the University of Minnesota’s Outstanding Achievement Award (OAA). The highest award the University presents to alumni, the OAA is conferred only on graduates, or former students of the University, who have attained unusual distinction in their chosen fields or professions or in public service, and who have demonstrated outstanding achievement and leadership on a community, state, national, or international level.

Litterman studied human biology and physics as an undergrad at Stanford and worked as a journalist before coming to CLA to earn his doctorate in economics. He went on to join the economics faculty at MIT, an extraordinary placement for a new PhD, and then returned to Minnesota to work as a research economist at the Federal Reserve Bank of Minneapolis. That was followed by a successful 23-year career at Goldman Sachs where he researched and published groundbreaking academic papers in asset allocation and risk management and co-developed the famous Black-Litterman Global Asset Allocation Model, an investment management tool still widely used. In 2010 he became a founding partner of Kepos Capital, a New York-based globally-focused asset management firm. He is a global thought leader on climate change and shares his expertise through serving on a number of boards, including the Heller-Hurwicz Economics Institute, World Wildlife Fund, Robert Wood Johnson Foundation, and the Climate Leadership Council. He chaired the U.S. Commodity Futures Trading Commission Climate-Related Market Risk Subcommittee, which published its report, “Managing Climate Risk in the U.S. Financial System,” in September 2020.

Upon the clarity-inducing realities of COVID-19, he and his wife Mary moved permanently to their home in California to be near family and recently took some time to answer questions about his path to and from CLA.

Where did you first gain your appreciation for using technology in risk management?

You know, my earliest memory of a random number generator would have to be playing dice baseball with my older brother (who became a nuclear engineer). We would do that for days on end; we’d run a whole season. This was long before computer games. In a way, dice, which was a technology invented 3,000 years ago, could have been the start of my love for simulations and randomness. And I couldn't wait when I was in high school for computers. I had heard and read about them, but there were no computers in the state of Arizona when I grew up there. I remember the first computer arriving. I was the president of the math club at Camelback High School and we did a field trip to Arizona Public Service which had received the first IBM mainframe computer in the state of Arizona, and we watched them program in powers of two.

How did the COVID pandemic affect your life?

You really miss the personal interactions and conversations. But I’ve also learned that I don’t need to fly all over the world to do business. Before COVID, I’d be on the road three days a week. With travel to Europe and Asia, I was a million miles flyer. Since COVID, I’ve taken only two flights and am loving not traveling as much. I Zoom with Europe in the morning, the US during the day, and Asia at night. (Not traveling so much also means I lost 25 pounds and am back to my weight in high school.) It’s nice being able to chat at a moment's notice, attend classes, webinars, and seminars. Where before there might be 20 people at a seminar, now there can be 300 at a webinar. And then—like everyone else—I have 25 things I could look at every day, so managing time becomes a real challenge.

One of the biggest changes is living in California. We weren’t planning to move here at the time of COVID, but we were sheltering in place with the kids and the grandkids. I flew out here on March 12 from DC where I had been testifying to Congress and we’ve been here ever since. We sold our house in New Jersey and changed our residency permanently. It happened quickly. We were sort of planning to come out here eventually and retire here. But if you asked me two years ago, I would have said we’d make the change in five years. We’re seeing the grandkids more because they live nearby. We’re just so lucky. Our outcome has not been bad.

From where or whom have you drawn your inspiration and perspectives?

There are so many people out there. It started in Minnesota with two of my advisers: Chris Sims and Tom Sargent, both Nobel Laureates. And Lars Hansen was a graduate student one year ahead of me—he also won the Nobel. Many people at MIT and professionally at Goldman Sachs. Where do I get my inspiration? All around. All around.

I’ve always been curious. I started (during the Vietnam War) as a physics major, but that allowed one elective in four years. And I just wasn’t sure I wanted to be a physicist. So I dropped into a new program called human biology. I was in the inaugural class in 1970. It’s a popular major, and for me, it was a great education to be studying human behavior. I also worked at the student newspaper and thought I was going to be a journalist. My first job was at the San Diego Union as a general assignment reporter, but I didn’t want to keep living in El Centro and decided to go back to graduate school to study human behavior. I spent a year as a graduate student at the University of California San Diego where I met my wife Mary. She was from Minnesota and went back to finish her education at the U of M, so I came to Minnesota in August of 1974 and met with Neil Wallace, who took pity on me, told me I was welcomed at the University, but there wasn’t any money left. He did get me an interview for a job at the computer center—this was when there was a big mainframe at an off-campus site in Lauderdale. I got a job as a consultant helping students and I learned a lot about programming.

Then when I was ready to graduate, my adviser Tom Sargent asked, “Bob, where do you want to teach?” And I told him I didn’t think I wanted to teach and was going into business. Well, he was surprised. He said, “Look, academia is a one-way street. If you think you might want to do it, you have to do it now. So I did and accepted an offer from MIT. And I have to be honest, it was about what I expected. I want to have an impact and understand how the world works. I didn’t want to study and teach it. That’s why I decided I wanted to go into business.

What would you recommend young students pay attention to today?

When you get out of school or are working at that first job, you need to focus on building human capital. It’s not about the title. It’s not about the compensation. What are you learning? You need to have a dream and then determine how you are going to build toward that dream through knowledge.

What was one of your most memorable or surprising experiences during your time studying economics in CLA?

There were a lot of things. But here is one that created a lot of scar tissue. I flunked my microeconomics preliminary test. Herbert Mohring was chair of the micro prelim that year and he had a very simple question: Defend the policy of smoothing oil prices. I, being a macro student, had studied how to use optimal control theory to react to shocks. So I wrote down this economy, optimal control problem, and put the volatility of prices in the utility function, and I showed how to minimize that volatility by adjusting flows, and all that. I thought for sure I’d get full credit. I got zero. That was 30 points out of 100. I went to Professor Mohring and asked, “How could I get zero points for this?” And he said, “There is no defense. That's all you had to say. Bob, prices don’t belong in the utility function.” It was a fundamental error. I deserved to flunk and had to take the test over. It involved a lot of studying. A lot of pain. The reason I bring this up is that it connects to climate change. You don’t smooth prices. The price of emissions should be high; today it is zero. It shouldn’t get there slowly. It should jump immediately to the appropriate level. Those incentives to reduce emissions are the only brake that we have to address climate change. That is why I call pricing emissions “slamming on the brakes.” It’s urgent! So that scar tissue from my education was useful.

What do you really want everyone to know and understand about taking action around climate change?

This is about human well-being. This is one of those risk management failures that is just obvious to someone with a risk management background. It’s obvious what we need to do about it. It’s like a computer bug. There’s something wrong with the code. You identify it and you fix it—immediately. You don’t sit around waiting. And that’s what we have now in the global economic system. It’s a very simple bug to fix. But we don’t have incentives. There should be strong incentives to reduce emissions. I think everyone understands that. Sure, we process information, we have language, But human beings are not rational. Nonetheless, we do respond to incentives. Incentives are things that change behavior. If we want fewer emissions, then we need to create incentives. That’s how you change behavior. For a modern, capitalistic society with markets, that means prices and wages. It’s so simple and obvious. It costs nothing to change the tax code.

And right now, we’re very close; I’m very optimistic. I think we can fix this. I certainly hope that the planet is robust and recovers well. But my background is risk management, and hope and prayer are not risk-management strategies. We humans have the ability to see the consequences of our actions. Think about it as a tipping point or going over a cliff. When you run out of time and you go off the cliff, it’s too late.

We’re speeding toward the edge and we don’t know where the edge is. I have used the example of the flaming truck. In 2014 my wife Mary and I were driving into New York City to see a musical with friends. She saw a flaming truck out of control coming toward us and warned me. It was pouring rain. I looked up, saw this big truck, which turned out to be a gasoline tanker, in flames far down the road, slammed on the brakes, and moved to the right. And in the next five seconds, we watched the truck crossing, and bouncing back and forth, until it hit the cement divider—the cab of the 18 wheeler bounced up and landed right in front of us. And it just exploded. We couldn’t stop. We were still going about 15 or 20 miles an hour when we passed by, avoiding it by about a foot. The heat was amazing. There were scrapes on the car and it was covered with oil. We were the only car to get by. All sides of the freeway were closed for seven hours. Where we are now with climate change is where I was when Mary exclaimed, “Oh my god, Bob, Watch out!” Science is giving us a clear warning. It is time to slam on the brakes.

We have a brake. It’s called a price on carbon. We are so close, but we have yet to do it globally, so it’s not just the US. Europe is far ahead of us on this. They have strong incentives. We are historically one of the biggest polluters on the planet. We could go into why...politics are broken, it’s social media, whatever. It doesn’t matter. It’s our grandchildren. My four grandchildren most likely will be alive at the end of this century when the temperature is peaking. It’s going to be a few degrees warmer and it’s not going to be good for nature. Why am I passionate? Because this is insane. And it’s our actions right now that determine what the future will be.